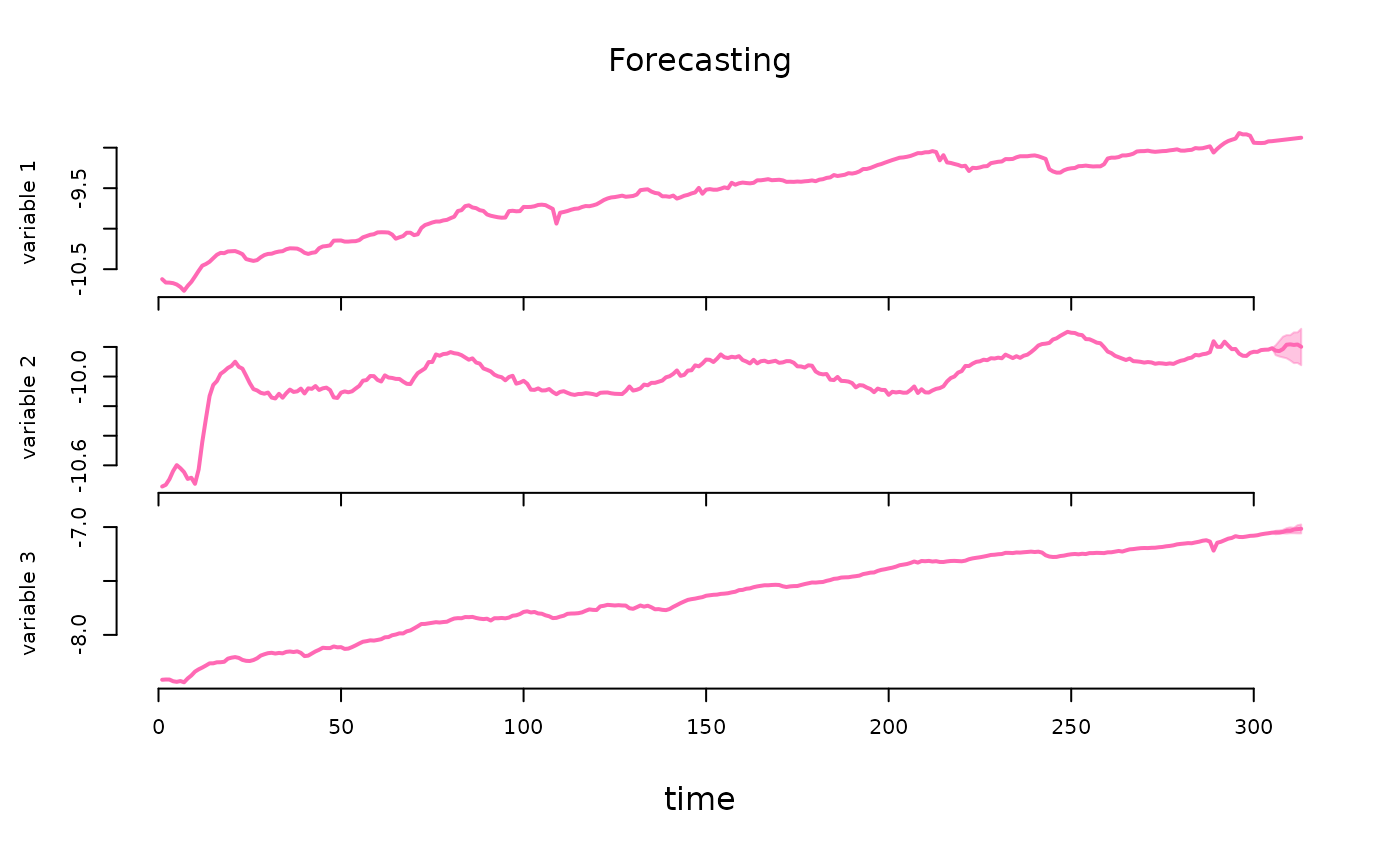

Forecasting using Bayesian Structural Vector Autoregression

Source:R/forecast.R

forecast.PosteriorBSVAR.RdSamples from the joint predictive density of all of the dependent

variables for models at forecast horizons from 1 to horizon specified as

an argument of the function.

Usage

# S3 method for class 'PosteriorBSVAR'

forecast(

object,

horizon = 1,

exogenous_forecast = NULL,

conditional_forecast = NULL,

...

)Arguments

- object

posterior estimation outcome - an object of class

PosteriorBSVARobtained by running theestimatefunction.- horizon

a positive integer, specifying the forecasting horizon.

- exogenous_forecast

a matrix of dimension

horizon x dcontaining forecasted values of the exogenous variables.- conditional_forecast

a

horizon x Nmatrix with forecasted values for selected variables. It should only containnumericorNAvalues. The entries withNAvalues correspond to the values that are forecasted conditionally on the realisations provided asnumericvalues.- ...

not used

Value

A list of class Forecasts containing the

draws from the predictive density and for heteroskedastic models the draws

from the predictive density of structural shocks conditional standard

deviations and data. The output elements include:

- forecasts

an

NxTxSarray with the draws from predictive density- Y

an \(NxT\) matrix with the data on dependent variables

- forecast_mean

an

NxTxSarray with the mean of the predictive density- forecast_covariance

an

NxTxSarray with the covariance of the predictive density

Author

Tomasz Woźniak wozniak.tom@pm.me

Examples

specification = specify_bsvar$new(us_fiscal_lsuw)

#> The identification is set to the default option of lower-triangular structural matrix.

burn_in = estimate(specification, 5)

#> **************************************************|

#> bsvars: Bayesian Structural Vector Autoregressions|

#> **************************************************|

#> Gibbs sampler for the SVAR model |

#> **************************************************|

#> Progress of the MCMC simulation for 5 draws

#> Every draw is saved via MCMC thinning

#> Press Esc to interrupt the computations

#> **************************************************|

posterior = estimate(burn_in, 5)

#> **************************************************|

#> bsvars: Bayesian Structural Vector Autoregressions|

#> **************************************************|

#> Gibbs sampler for the SVAR model |

#> **************************************************|

#> Progress of the MCMC simulation for 5 draws

#> Every draw is saved via MCMC thinning

#> Press Esc to interrupt the computations

#> **************************************************|

predictive = forecast(posterior, 4)

# workflow with the pipe |>

############################################################

us_fiscal_lsuw |>

specify_bsvar$new() |>

estimate(S = 5) |>

estimate(S = 5) |>

forecast(horizon = 4) -> predictive

#> The identification is set to the default option of lower-triangular structural matrix.

#> **************************************************|

#> bsvars: Bayesian Structural Vector Autoregressions|

#> **************************************************|

#> Gibbs sampler for the SVAR model |

#> **************************************************|

#> Progress of the MCMC simulation for 5 draws

#> Every draw is saved via MCMC thinning

#> Press Esc to interrupt the computations

#> **************************************************|

#> **************************************************|

#> bsvars: Bayesian Structural Vector Autoregressions|

#> **************************************************|

#> Gibbs sampler for the SVAR model |

#> **************************************************|

#> Progress of the MCMC simulation for 5 draws

#> Every draw is saved via MCMC thinning

#> Press Esc to interrupt the computations

#> **************************************************|

# conditional forecasting using a model with exogenous variables

############################################################

specification = specify_bsvar$new(us_fiscal_lsuw, exogenous = us_fiscal_ex)

#> The identification is set to the default option of lower-triangular structural matrix.

burn_in = estimate(specification, 5)

#> **************************************************|

#> bsvars: Bayesian Structural Vector Autoregressions|

#> **************************************************|

#> Gibbs sampler for the SVAR model |

#> **************************************************|

#> Progress of the MCMC simulation for 5 draws

#> Every draw is saved via MCMC thinning

#> Press Esc to interrupt the computations

#> **************************************************|

posterior = estimate(burn_in, 5)

#> **************************************************|

#> bsvars: Bayesian Structural Vector Autoregressions|

#> **************************************************|

#> Gibbs sampler for the SVAR model |

#> **************************************************|

#> Progress of the MCMC simulation for 5 draws

#> Every draw is saved via MCMC thinning

#> Press Esc to interrupt the computations

#> **************************************************|

# forecast 2 years ahead

predictive = forecast(

posterior,

horizon = 8,

exogenous_forecast = us_fiscal_ex_forecasts,

conditional_forecast = us_fiscal_cond_forecasts

)

summary(predictive)

#> **************************************************|

#> bsvars: Bayesian Structural Vector Autoregressions|

#> **************************************************|

#> Posterior summary of forecasts |

#> **************************************************|

#> $variable1

#> mean sd 5% quantile 95% quantile

#> 1 -8.914237 0 -8.914237 -8.914237

#> 2 -8.908921 0 -8.908921 -8.908921

#> 3 -8.903604 0 -8.903604 -8.903604

#> 4 -8.898288 0 -8.898288 -8.898288

#> 5 -8.892971 0 -8.892971 -8.892971

#> 6 -8.887655 0 -8.887655 -8.887655

#> 7 -8.882338 0 -8.882338 -8.882338

#> 8 -8.877022 0 -8.877022 -8.877022

#>

#> $variable2

#> mean sd 5% quantile 95% quantile

#> 1 -9.820603 0.03086056 -9.862634 -9.798432

#> 2 -9.822402 0.04101902 -9.870001 -9.775046

#> 3 -9.843243 0.02401174 -9.872130 -9.819634

#> 4 -9.852286 0.03148237 -9.889824 -9.818935

#> 5 -9.826167 0.03807344 -9.866884 -9.779551

#> 6 -9.817373 0.05242236 -9.876198 -9.756273

#> 7 -9.812346 0.04289914 -9.847883 -9.758555

#> 8 -9.817585 0.03946899 -9.847468 -9.763915

#>

#> $variable3

#> mean sd 5% quantile 95% quantile

#> 1 -7.036484 0.03803271 -7.074954 -6.988231

#> 2 -7.020970 0.05852565 -7.085975 -6.951426

#> 3 -7.005532 0.05045013 -7.060817 -6.946847

#> 4 -7.003896 0.06806594 -7.075618 -6.926386

#> 5 -7.010716 0.08237156 -7.104411 -6.925612

#> 6 -7.003595 0.09733435 -7.115237 -6.893173

#> 7 -6.995018 0.09854849 -7.105950 -6.888221

#> 8 -6.989971 0.10518358 -7.090396 -6.858711

#>

# workflow with the pipe |>

############################################################

us_fiscal_lsuw |>

specify_bsvar$new( exogenous = us_fiscal_ex) |>

estimate(S = 5) |>

estimate(S = 5) |>

forecast(

horizon = 8,

exogenous_forecast = us_fiscal_ex_forecasts,

conditional_forecast = us_fiscal_cond_forecasts

) |> plot()

#> The identification is set to the default option of lower-triangular structural matrix.

#> **************************************************|

#> bsvars: Bayesian Structural Vector Autoregressions|

#> **************************************************|

#> Gibbs sampler for the SVAR model |

#> **************************************************|

#> Progress of the MCMC simulation for 5 draws

#> Every draw is saved via MCMC thinning

#> Press Esc to interrupt the computations

#> **************************************************|

#> **************************************************|

#> bsvars: Bayesian Structural Vector Autoregressions|

#> **************************************************|

#> Gibbs sampler for the SVAR model |

#> **************************************************|

#> Progress of the MCMC simulation for 5 draws

#> Every draw is saved via MCMC thinning

#> Press Esc to interrupt the computations

#> **************************************************|