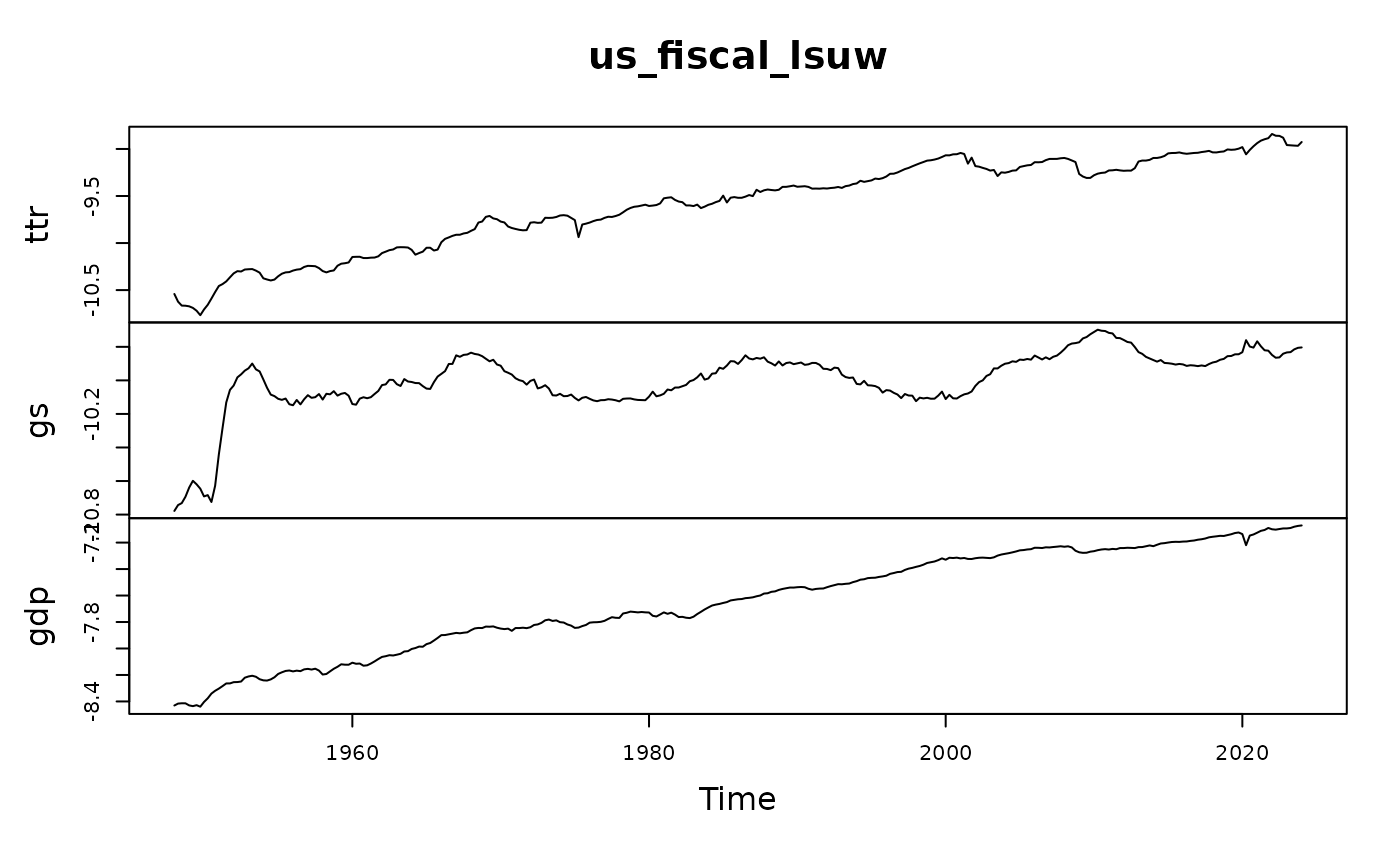

A 3-variable US fiscal system for the period 1948 Q1 – 2024 Q2

Source:R/us_fiscal_lsuw.R

us_fiscal_lsuw.RdA system used to identify the US fiscal policy shocks. Last data update was implemented on 2024-10-20.

Usage

data(us_fiscal_lsuw)Format

A matrix and a ts object with time series of over three hundred observations on 3 variables:

- ttr

quarterly US total tax revenue expressed in log, real, per person terms

- gs

quarterly US total government spending expressed in log, real, per person terms

- gdp

quarterly US gross domestic product expressed in log, real, per person terms

The series are as described by Mertens & Ravn (2014) in footnote 3 and main body on page S3 of the paper. Differences with respect to Mertens & Ravn's data :

The sample period is from quarter 1 of 1948 to the last available observation,

The population variable is not from Francis & Ramey (2009) but from the FRED (with the same definition),

The original monthly population data is transformed to quarterly by taking monthly averages.

Source

U.S. Bureau of Economic Analysis, National Income and Product Accounts, https://www.bea.gov/

FRED Economic Database, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/

References

Francis, N., and Ramey, V.A. (2009) Measures of per capita Hours and Their Implications for the Technology‐hours Debate. Journal of Money, Credit and Banking, 41(6), 1071-1097, DOI: doi:10.1111/j.1538-4616.2009.00247.x .

Mertens, K., and Ravn, M.O. (2014) A Reconciliation of SVAR and Narrative Estimates of Tax Multipliers, Journal of Monetary Economics, 68(S), S1–S19. DOI: doi:10.1016/j.jmoneco.2013.04.004 .

Lütkepohl, H., Shang, F., Uzeda, L., and Woźniak, T. (2024) Partial Identification of Heteroskedastic Structural VARs: Theory and Bayesian Inference. University of Melbourne Working Paper, 1–57, doi:10.48550/arXiv.2404.11057 .